API calculation requirements

Landed Cost calculates the import customs clearance charges when the carrier and service level are provided in the API request.

For a full list of acceptable service levels and codes, see the carrier service levels doc.

Landed cost request

{

"shipping": {

"amount": 14.23,

"amount_discount": 0,

"service_level": "ups_express_saver"

}

}

Shipment rating feature

If you are using Zonos' Rating API to calculate your shipping costs, then the appropriate amount and service_level will be returned in the rating response, which can then be used in your landed cost request.

Checkout and Quoter use the shipment rating feature to calculate shipping, which automatically returns the shipping rate with clearance fees included.

Rating object

{

"id": "ship_1Ce6vt2eZvKYlo2CrgzPqxaz",

"amount": {

"shipping": 23.51,

"fuel": 29.11,

"out_of_area": 25.71

},

"service_level": "ups_express_saver"

}

The amount and service_level can be used in the Landed Cost request.

Fees schema

The Landed Cost object contains the clearance fee charges and details inside the fees schema.

Landed cost object

{

"fees": [

{

"amount": 19.22,

"description": "Handling Fee",

"formula": "22 EUR",

"item_id": null,

"note": "An Post Handling Fee",

"type": "advancement"

}

]

}

Fees schema details

| Property | Description |

|---|---|

amount | The fee in the base currency (typically converted from another currency) |

description | The description of the fee by the clearance entity |

formula | Typically a set fee amount or percentage |

item_id | Reference to your item ID |

note | Additional information on the fee |

type | The type of fee charged, which is different than the entity’s description of their fee (advancement, brokerage, etc. See “Import clearance fees” table below) |

Fee types

Learn more by reading about different import fee types below.

There are different types of import or clearance fees Zonos calculates with the Landed Cost product.

The table below lists the fees that may be calculated, which will be displayed under the property: type in the fees schema for the Landed Cost object response.

| Type | Description |

|---|---|

additional_tariff_lines | May apply when the line items on a commercial invoice exceed a preset number |

advancement | Charged by most, if not all, carriers for fronting cash to customs |

brokerage_fee | The brokerage firm clears the package, which is common on ground shipments to Canada |

cod | (Collect on delivery) charged to the importer when sent DDU |

country | Charged by the import country |

currency_conversion | Shipping carriers and brokers charge a percentage of the converted amount |

ddp_service_fee | UPS charges this fee when billing duties and taxes to someone other than the recipient |

other | Other non-standard fees charged by the carrier, broker, or customs |

zonos_landed_cost_guarantee | Zonos' fee for the guarantee of a Landed Cost quote |

additional_tariff_lines

When a commercial invoice exceeds a predetermined amount of line items, Zonos will calculate the additional line item fee. For instance, UPS charges 400 JPY per additional tariff line exceeding five tariff lines into Japan, and FedEx charges 55 NOK per additional line item beyond five entries into Norway.

advancement

Advancement fees are charged by carriers for paying duty and tax to customs on your behalf upon import. Landed Cost calculates the different advancement fees by the carrier, country, and currency. These fees are charged by the carrier in the destination country. In most cases, the carrier’s duty and tax APIs do not calculate these fees.

Whether you absorb the cost of the duties and taxes or bill your customers for these charges, the duties and taxes will be collected. We recommend collecting these fees at checkout to avoid surprise bills and unhappy customers. If you can negotiate a discount on the advancement fee, then it is beneficial to send shipments Delivered Duties Paid (DDP) because the discount typically only applies to the negotiation made with the carrier. If you have a negotiated advancement fee and the shipment is sent Delivered Duties Unpaid (DDU)/Delivered at Place (DAP), the consignee will likely get the book rate on the advancement fee.

brokerage_fee

Most international air shipments are not charged a brokerage fee; however, ground shipments to Canada, such as Standard with UPS and Ground with FedEx, will be charged a brokerage fee for clearance. To learn more about brokerage fees and other fees to Canada, see our blog post on UPS, FedEx, and DHL Brokerage Fees to Canada. There are countries where the carrier is not the broker and the broker may charge the carrier a fee for clearance. This fee is charged in addition to the advancement, DDP, or cash on delivery (COD) fee.

cod

COD fees will be charged on almost all DDU shipments (where the duties and taxes are collected from the recipient, not the sender). These are commonly charged by UPS, FedEx, DHL, and the delivery entity for the postal courier.

For example, USPS delivery partners, such as Canada Post or Royal Mail, charge COD fees on all First Class and Priority United States (U.S.) mail that incurs duties and taxes.

In the case of a DDP landed cost calculation by Landed Cost, COD fees may not be calculated; however, if the landed cost is an estimate to a shopper of what might be charged, then the COD fee will be included.

country

The importing country may have fees assessed on certain shipments. These fees can be assessed for a wide variety of reasons, but usually represent services rendered by various government departments for things such as clearance, approval, inspection, storage, quarantine, processing, etc.

currency_conversion

Many carriers will assess a fee for invoicing in a foreign currency. This is most commonly seen on a DDP shipment duty and tax invoice since the duty and tax is assessed in the currency of the destination country but the invoice is sent to the shipper or a third party in a different currency. This currency conversion fee is typically reflected in the exchange rate used by the carrier and is not listed as a separate line item.

ddp_service_fee

DDP shipments, better described as billing duties and taxes to the shipper, may be charged a fee by the exporting carrier for providing the service to the shipper. This is not the same charge as a typical import charge, such as an advancement fee, because it is technically charged by the export carrier rather than the destination carrier.

For example, UPS U.S. charges 15 USD to bill the shipper or third party as a service.

other

There are other fees charged by carriers or customs that may be applied to an international shipment.

For example, shipping fees can be applied by government bureaus like the U.S. Food and Drug Administration (FDA).

To learn more about clearance fees, and what carriers charge them, see our total landed cost guide.

Landed Cost guarantee

zonos_landed_cost_guarantee

Many merchants take advantage of the Landed Cost guarantee to simplify business processes and create peace of mind. With this service, Zonos will guarantee the landed cost calculations and handle all of the duty and tax registration, collection, payment, and reconciliation. An administrative fee for this service is built into the landed cost calculations.

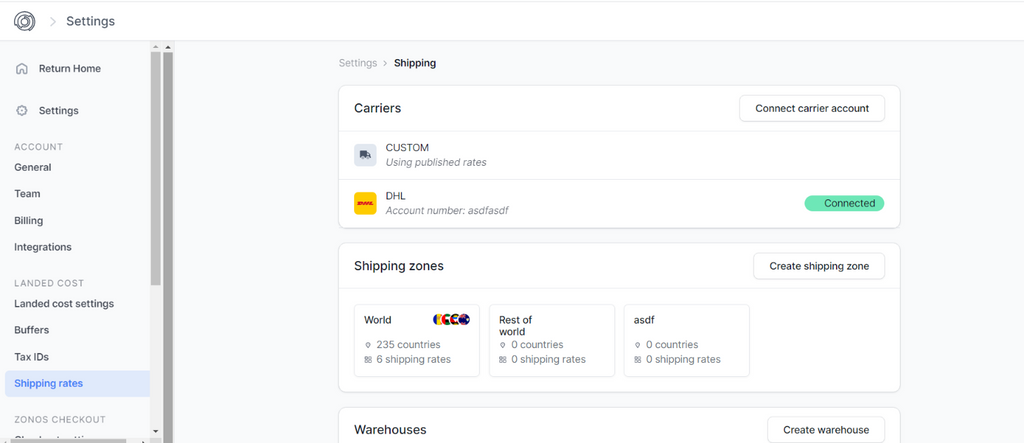

Customize carrier import fees

Some clearance fees are negotiable, especially with UPS, FedEx, and DHL. If you have negotiated the DDP fee with UPS or FedEx, you can modify the fees inside the Dashboard. Navigate to Settings -> Shipping rates so that they are reflected correctly in your calculations. Customization is also available for DDP, advancement, and brokerage fees.

Frequently asked questions

How accurate is Zonos at calculating customs clearance fees?

Our Decoder team sources clearance fees directly from carriers, delivery providers, and brokers, as well as their invoices. Zonos is determined to give you the most accurate landed cost calculations on the market. However, because of the constant change of international rates and policies, we do recommend using Landed Cost guarantee for complete peace of mind.

What if my currency does not match the currency of the fees?

The Landed Cost API and other Zonos products take into account exchange rates at the time a request was sent. While our calculations are the most accurate on the market, constant fluctuations in currency values mean that there may be a margin for error. We recommend using Landed Cost guarantee to absolve any worry about these small discrepancies.

How up-to-date are your exchange rates?

We fetch an updated exchange rate every two hours. However, the currency conversion rate used at the time of customs clearance will not match a currency conversion rate used at the time of an ecommerce order. Again, Landed Cost guarantee can be used to avoid differences in calculations and billing from your carrier.

How do you calculate customs clearance and import fees?

Import fees can be complicated. They can be applied by brokers, government agencies, customs, and carriers. They can vary based on many different factors, like the type of good or even the shipping service level that was used on the import. Zonos can do the heavy lifting for you when calculating import fees. Landed Cost, Checkout, and Quoter can all calculate import fees as part of a total landed cost calculation.

Does Zonos Hello calculate clearance import fees?

For current Zonos customers, Hello can be configured to include the most commonly-used carrier and service level to calculate the clearance fee.

Import fees

Learn about import fees and how they are calculated.Import fees are variable fees that may be applied by brokers, government agencies, customs, and carriers. These fees can change based on many different factors, like the type of good or even the shipping service level that was used on the import.

An import is 39% more likely to be charged an import/clearance fee rather than a duty. Import fees are often overlooked and vary by country and carrier. Zonos Landed Cost calculates clearance fees by country, carrier, carrier service level, and currency to 235 different territories. View our landed cost guide to learn more about clearance fees and how they are applied to landed cost.