Ease of importing goods score: D

Ease of doing business 2/5

- The Federal Customs Service of Russia tends to be strict.

- Russia’s World Trade Organization membership adds some ease to doing business in the country.

Landed cost fairness 3/5

- Russia has a relatively high duty and tax de minimis and a relatively low duty rate, which is favorable for landed cost.

- Russia's high import tax rate can increase landed cost.

- Russia has a weight and value de minimus threshold that, when exceeded, requires a broker to clear the shipment.

Flexibility of legal regulations 1/5

- Russia has many regulations in place designed to protect its citizens, including safeguarding consumer data and preventing “unfair” competition, which can make advertising and compliance difficult for those seeking to expand their sales internationally to Russia.

- The Federal Customs Service of Russia is rigid and unwavering with their regulations.

Availability and accessibility of shipping 2/5

- The major international carriers ship to Russia, but with limitations (see the Shipping and compliance section below).

- Because of Russia’s strictness at customs, and the large size of the country, it can take a while for the package to clear customs and ship to your consumer’s location. This may result in premature customer complaints of lost packages.

Accessibility and variety of payment methods 5/5

- Russia accepts a variety of popular payment methods, including cards, digital wallets, etc.

Market opportunity 3/5

- With a little over half of the population shopping online, Russia’s ecommerce market is an opportunity worth looking into.

Key stats for Russia

| Population | 146.08 million (2022) |

| GDP | 2.133 trillion USD (2022) |

| GDP per capita | 12,218.70 USD (2022) |

| Internet penetration | 83.42% of the population use the internet (2022) |

| Ecommerce users | 52.4% of the population shop online (2022) |

| Leading product categories | Household appliances, electronics, and fashion |

| Preferred online payment method(s) | Debit card, digital wallet, credit card, and bank transfer |

| Language(s) | Russian, Tatar, Cechen, Bashkir, Ukranian, and Chuvash |

| Currency | Russian ruble/RUB/₽ |

Landed cost for Russia

The landed cost for a cross-border transaction includes all duties, taxes, and fees associated with the purchase. This includes:

- Product price

- Shipping

- Duties

- Taxes

- Fees (currency conversion, carrier, broker, customs, or government fees)

Russian de minimis, tax, and duty

CIF: CIF (cost, insurance, freight) is a method for calculating import taxes where the tax is calculated on the cost of the order, plus the cost of freight, insurance, and seller's commission.

Duty and tax de minimis

Although Russia’s official currency is RUB, the de minimis is expressed in Euros (EUR) because the shipments are reviewed before entering the country, and it is documented in EUR.

- Duty and tax de minimis: 200 EUR

Applied to the CIF value of the order

De minimis value

Duty and tax will be charged only on imports into Russia where the total CIF value of the import exceeds Russia’s minimum value threshold (de minimis), which is 200 EUR. Russia also operates a weight de minimis of 31 kg. Anything under the de minimis value and weight will be considered a duty and tax-free import.

If a package exceeds the de minimis value or weight, it will not be allowed to enter Russia unless the recipient hires a customs broker to clear the package.

It is strongly recommended that you do not exceed these thresholds because some carriers will restrict entry into the country due to the concern of the recipient having to self clear the shipment with their own broker.

Import duty and tax

- Standard combined rate: 15%

Applied to the CIF value of the order

Duty and Value-added tax (VAT)

Russia has a VAT is a standard combined duty and tax rate of 15%. The 15% combined rate is applied to all imports into Russia valued greater than the de minimis (200 EUR). Duty and VAT are calculated based on the CIF value of the order.

The combined duty and tax fee will be waived if the charges do not exceed two EUR.

Excise tax

Certain goods being imported into Russia are subject to an excise tax (extra tax) and are regulated per Article 193 of Tax Code of the Russian Federation.

Landed cost examples for Russia

Below are sample landed cost breakdowns for Russia calculated using Zonos Quoter:

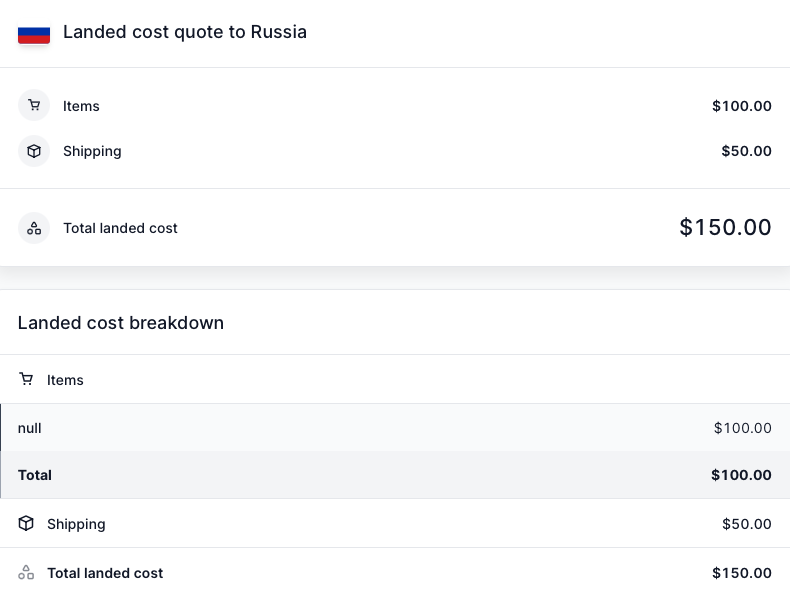

Landed cost for a shipment below the de minimis value:

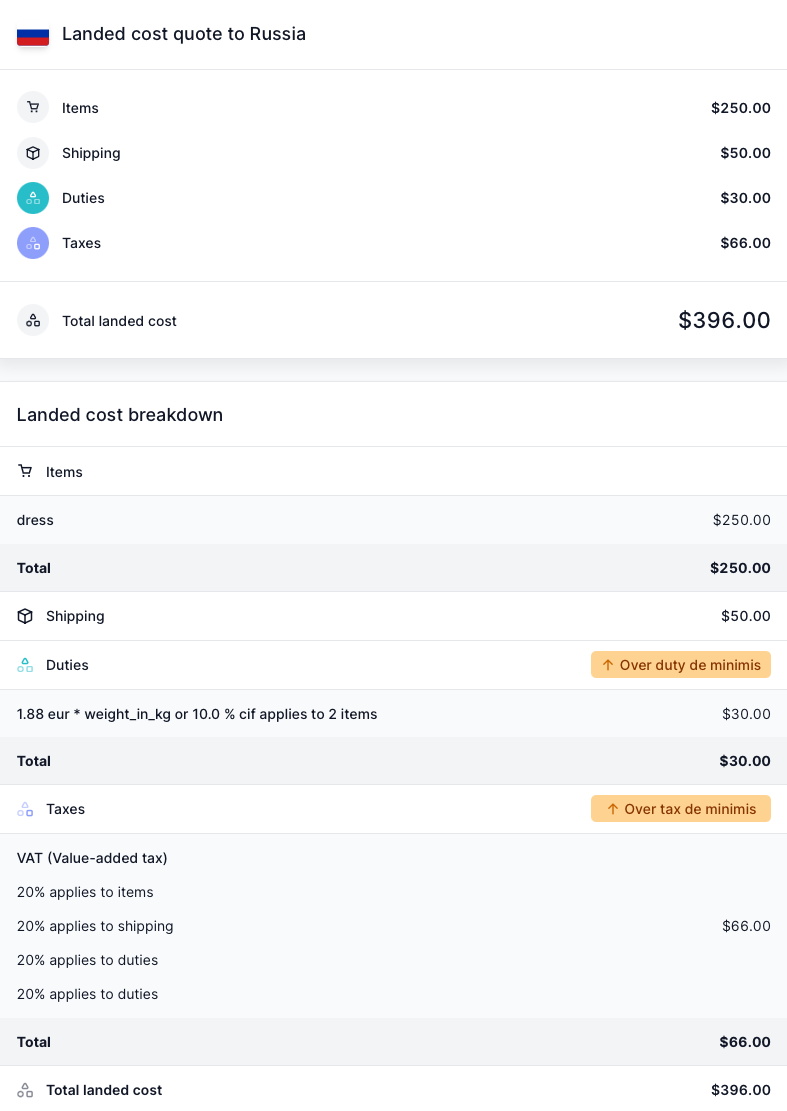

Landed cost for a shipment above the de minimis value:

Trade agreements

Russia has at least 12 trade agreements that offer a zero or highly discounted duty rate for goods made in a participating country. The most prominent trade group of which Russia is a member is the Eurasian Economic Union.

Eurasian Economic Union (EEU)

Russia is part of the Eurasian Economic Union and has minimal trade allowances between the Republic of Armenia, the Republic of Belarus, the Republic of Kazakhstan, and the Kyrgyz Republic. The union was launched between all five members on January 1, 2015, and since then, it focuses on multiple trade aspects.

Russia is a member of the World Trade Organization

Russia is a member of the World Trade Organization (WTO). Therefore, Russia must abide by the most-favored-nation (MFN) clause, which requires a country to provide any concessions, privileges, or immunities granted to one nation in a trade agreement to all other WTO member countries. For example, if a country reduces duties by 10% for one country, the MFN clause states that all WTO members will have their duties cut by 10% into that country.

Customs resources

Russia's Customs authority

Customs refund in Russia

Note: Talk to your carrier about customs refunds.

Shipping and compliance

Top courier services

-

DHL Express

- DHL only allows residential delivery in Russia with pre-approval. Talk to your DHL representative to learn how to get this approval.

- DHL packages are screened for value and weight prior to being allowed into Russia.

-

FedEx

- FedEx only supports business-to-consumer (B2C) shipments from ecommerce websites if the website has registered with the Russian government. Talk to your FedEx representative for assistance.

- FedEx packages are screened for value and weight prior to being allowed into Russia.

-

UPS

- UPS packages are screened for value and weight prior to being allowed into Russia.

-

USPS

- For all shipments containing goods destined for Russia, the Postal Service requires the associated 10-digit Schedule B number on the HS Tariff Number block on the customs declaration form.

Depending on the courier, additional shipping fees may include the following:

- Tracking fee

- Insurance fee

- Fuel surcharge

- Remote delivery charge

- Signature fee

- Overweight or oversized fee

- Special handling fee

- Dangerous goods fee

Documentation and paperwork

Always required:

Sometimes required:

-

Product description from the manufacturer (catalog, user manual, etc.)

-

Country of origin certificate (when applicable)

-

Cargo insurance document

- If the cargo is not insured - Letter disclosing that the cargo was not insured

-

Price list (official offer from seller)

-

Export declaration of the seller’s country with translation

-

If previous goods were released from customs and fall under this contract, a document that includes those previously-released goods for accounting purposes

-

Declaration of conformity

-

Sanitary certificates (when applicable)

Note: Check with your carrier to find out which documents are required.

Restricted, prohibited, and controlled items

Government agencies regulate imports.

Restricted items are different from prohibited items. Prohibited items are not allowed to be imported into a country at all. Restricted items are not allowed to be imported into a country unless the importer has approval or a special license that allows them. Controlled goods have military or national security significance.

Prohibited items:

- Service and civilian weapons, their major parts, and their ammunition

- Dangerous wastes

- Special technical means, meant for secretly obtaining information

- Ozone-destroying substances and products containing ozone-destroying substances

- Means of plant protection (pesticides) and other persistent organic pollutants

- Means of extraction (catching) of aquatic biological resources (fishing supplies, etc.)

- Poisonous substances, which are not the precursors of narcotic drugs and psychotropic substances

Restricted items:

- Printed or audio-visual information and other data storage devices

- Narcotic drugs, psychotropic substances, and their precursors, except limited amounts of narcotic and psychotropic substances in the form of medical agents for personal administration on medical indications when supported medical documents and prescriptions are present

- Human organs and/or tissues, blood, and their components

Carrier-specific prohibitions and restrictions

Legal regulations for businesses

Russia has regulations in place to protect its consumers when shopping via ecommerce with respect to the following:

-

Consumers' personal data

- Any extraction or storage of a consumer’s data in Russia initially happens in a Russian database.

-

Consumer rights

- The consumer has the right to reject goods at any time before they are delivered, or return them within seven days of delivery.

- The consumer can reject and return purchases within three months after delivery if the seller failed to provide the information on the procedure for returning goods.

- The consumer has the right to reject goods when the order was incorrect or defective.

- The consumer has the right to terminate the contract with the seller (through a request to the court) if the terms were unfavorable, and deemed so by the court.

If the consumer rejects a shipment within their rights, the seller must refund all costs paid to them by the consumer under the contract and deduct the cost of return shipping, all within 10 days of the consumer’s claim.

-

Advertising

- Foreign companies marketing to Russian consumers (through SMS, email, etc.) must gain consent before advertising to them. This can take the form of a checkbox allowing a consumer to select a box to either give or not give consent to an advertisement being shown to them.

-

Competition

-

Unfair competitive practices that mislead consumers or damage other businesses' competitive edge are unlawful, including the following:

- Slandering another company

- Falsely advertising your products (being untruthful about the quality, quantity, origin of manufacture, etc.)

- Comparing your products with those of another business entity

-

Requirements for a foreign business to sell to consumers in Russia

While Russia does not require foreign companies to have a location in Russia or any special licensing to sell to Russian consumers. However, the following is required on your website for your online business to legally sell into Russia:

- Privacy policy

- Terms and conditions

- Business legal name

- Business registration number (for wherever the business is located)

- Business address

- Business contact details

- Integrated accredited payment processor

Following all of Russia’s import regulations does not guarantee a smooth release into the country through customs. They are strict and may take a while to release the shipment, or they may still reject it if they feel it does not perfectly meet their standards.

Recipient self clearing imports

If a shipment exceeds Russia’s duty and tax de minimis (200 EUR), some carriers will restrict entry into the country due to the concern of the recipient having to self clear the shipment with their own broker.

Frequently asked questions

Do I have to translate my website to Russian when selling to Russian consumers?

While it is not required, it is recommended. Zonos Hello welcomes and provides customs and duty and tax information to your customers in their language.

Russia country guide

Learn about cross-border ecommerce, shipping, and importing.

DHL, FedEx, and UPS have ceased shipping services to Russia until further notice. Additionally, the information in this guide may not be up to date due to the conflict in the area.

If you are looking to grow your ecommerce business into Russia , you’ve come to the right place. Keep reading to learn everything you need to know about selling goods into Russia.

, you’ve come to the right place. Keep reading to learn everything you need to know about selling goods into Russia.