Ease of importing goods score: B

Ease of doing business 3/5

- Indonesia does not require businesses to register for a tax ID for ecommerce shipments, making it fairly easy on the retailer’s part.

- Indonesian consumers must register for an import license for various product types.

- Indonesia limits quantities on certain products, which can be difficult to monitor when selling to Indonesian consumers.

Landed cost fairness 2/5

- Indonesia’s standard duty and tax rates are reasonable, which is favorable for landed cost.

- The duty and tax de minimis values for Indonesia are extremely low, which means most imports will incur duty and tax, resulting in a higher landed cost.

Flexibility of legal regulations 4/5

- Though there aren’t many regulations that hinder businesses from selling to Indonesian consumers, there are quantity limits, import license requirements, and tax ID requirements on the consumer’s part.

Availability and accessibility of shipping 5/5

- All major international shipping carriers ship to Indonesia, making it accessible.

Accessibility and variety of payment method 5/5

- Indonesian consumers use globally accepted payment methods, such as debit cards, credit cards, and PayPal.

Market opportunity 5/5

- With the majority of Indonesia’s population shopping online, the market presents retailers with potential success.

Key stats for Indonesia

| Population | 278.8 million (2022) |

| GDP | $1.19 trillion USD (2021) |

| GDP per capita | $4,356 USD (2021) |

| Internet penetration | 70% of the population use the internet (2021) |

| Ecommerce users | 64% of the population shop online (2022) |

| Leading product categories | Fashion, electronics and media, and personal care |

| Preferred online payment method(s) | Credit and debit cards, PayPal, and mobile wallets |

| Languages | Indonesian, Japanese, English, and Sundanese |

| Currency | Indonesian Rupiah/IDR/Rp |

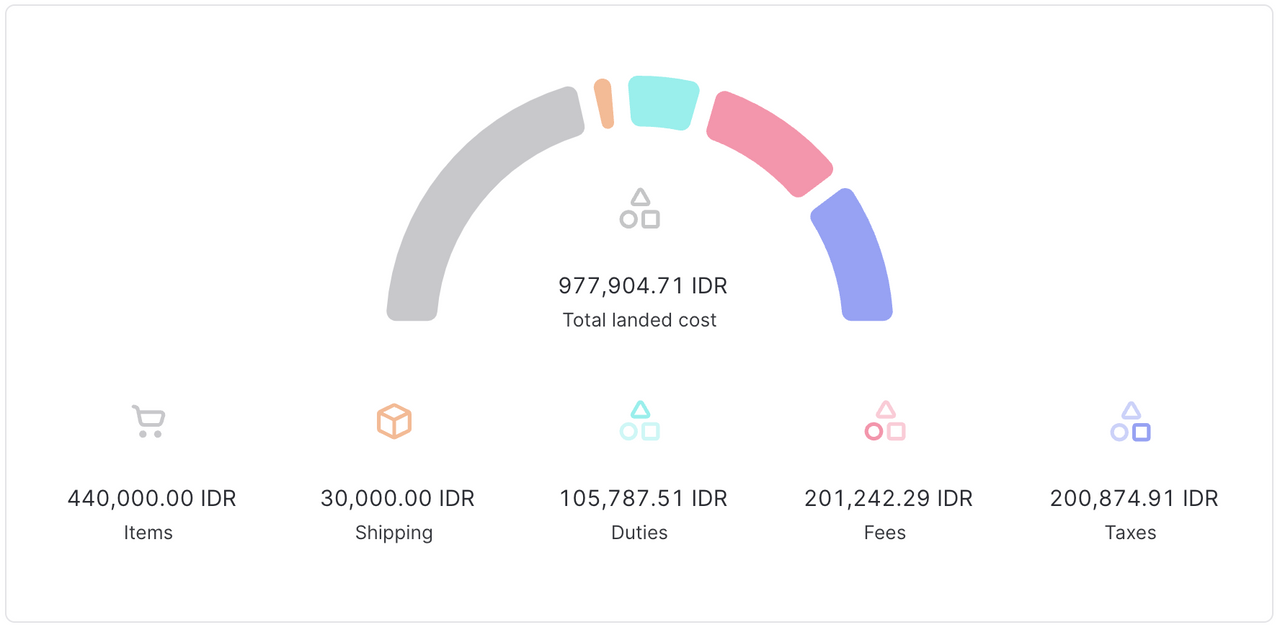

Landed cost for Indonesia

The landed cost for a cross-border transaction includes all duties, taxes, and fees associated with the purchase. This includes:

- Product price

- Shipping

- Duties

- Taxes

- Fees (currency conversion, carrier, broker, customs, or government fees)

Indonesian de minimis, tax, and duty

- CIF: CIF (cost, insurance, freight) is a method for calculating import taxes or duties where the tax is calculated on the cost of the order plus the cost of freight, and insurance.

- FOB: FOB (freight on board or free on board) is a valuation method for calculating import taxes or duties where the fees are calculated only on the cost of the goods sold. FOB is not calculated on the shipping, duty, insurance, etc.

Further explanation of de minimis, tax, and duty provided below

Duty and tax de minimis

- Tax de minimis: 0 USD

- Duty de minimis: 3 USD

Based on the FOB value of the order

De minimis value

Duty and tax will be charged only on imports into Indonesia where the total FOB value of the import exceeds Indonesia’s minimum value threshold (de minimis), which is 3 USD for duty and 0 USD for tax. All imports are subject to tax since the de minimis is zero, but anything under the duty de minimis value will be considered a duty-free import.

Import tax

- Standard rate: 11%

Applied to the CIF value of the order

Value-added tax (VAT)

The standard VAT rate for Indonesian imports is 11%.

Any other import tax

-

VAT on electronic products and services: If your business' sales in digital/electronic services exceed 600 million IDR and you generate traffic (website visits) from at least 12,000 users in Indonesia annually, then you may be appointed by the Director-General of Tax as a VAT collector and receive a tax ID number. If this is the case, you must collect and remit VAT quarterly for all sales based on the country’s requirements.

-

Income tax: The income tax rate (known as PPh) in Indonesia is 7.5% and 10% depending on the product. If an Indonesian Import Identification number (known as API) or tax ID number is provided with the import, then income tax rates will typically be 7.5%. If neither of these is provided, the income tax rate will be 15%.

Though the term “income tax” usually refers to a tax the government charges on its residents' personal income, in Indonesia, it is also a kind of import tax.

Import Duty

- Standard rate: 7.5%

Applied to the CIF value of the order

Duty rates

The standard duty rate for imports is 7.5%. Certain product categories have their own duty rates, such as the following:

- Shoes: 25-30%

- Textile materials: 15-25%

- Bags: 15-20%

Imports valued higher than 1,500 USD are subject to duty rates that vary based on the product and can be as high as 30%. These high-value imports are also subject to formal clearance, whih requires an additional 3-5 days.

Landed cost examples

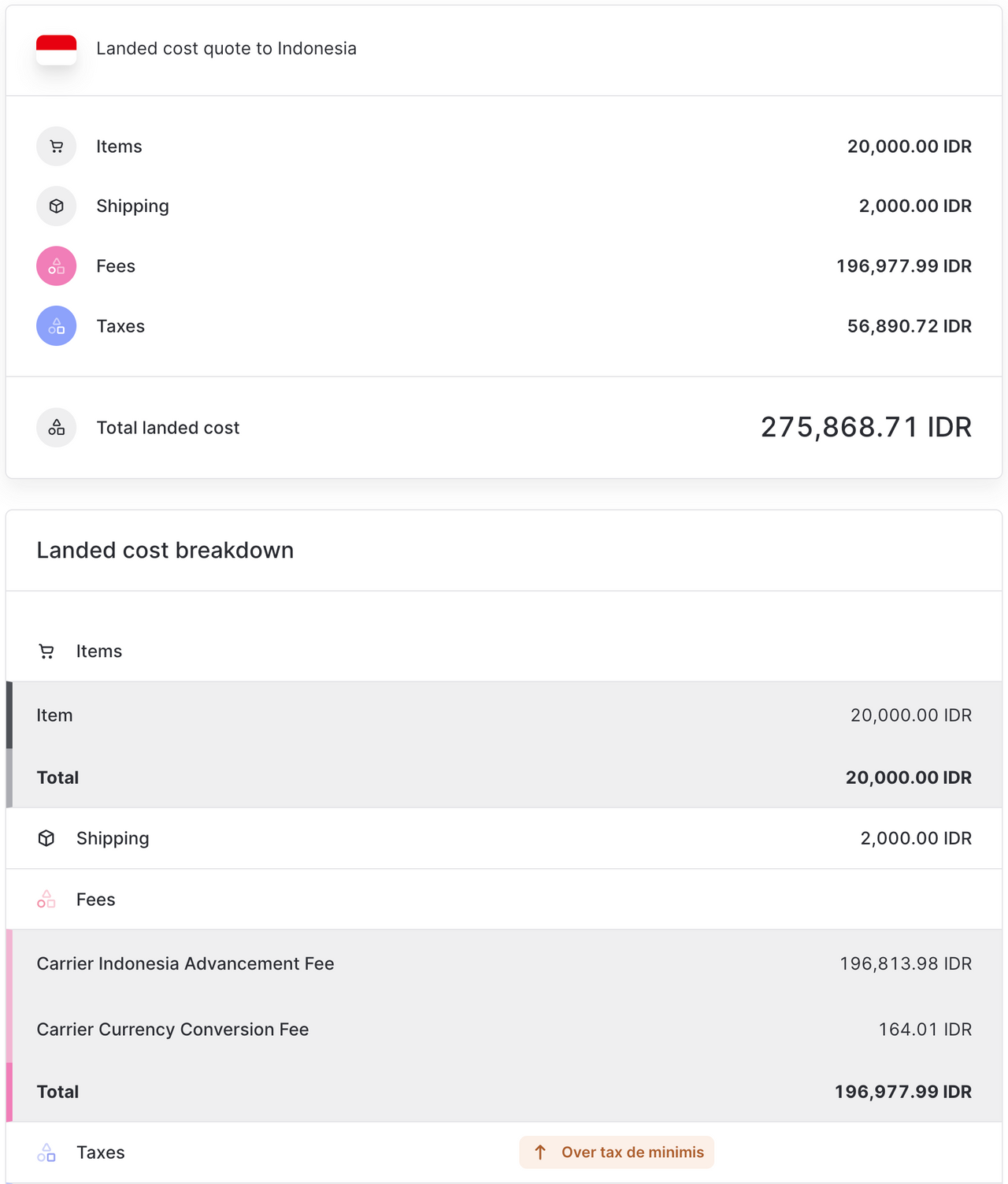

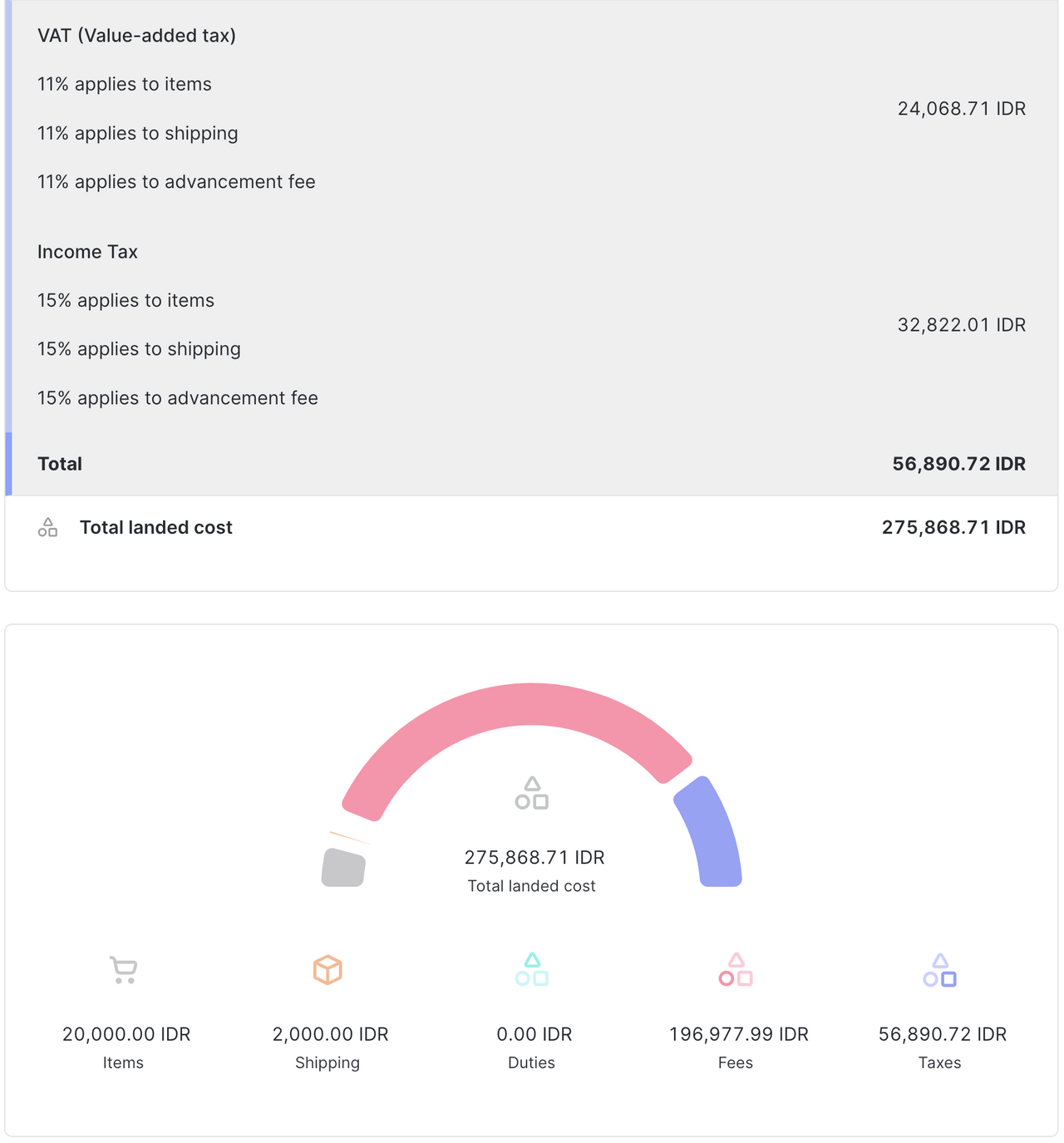

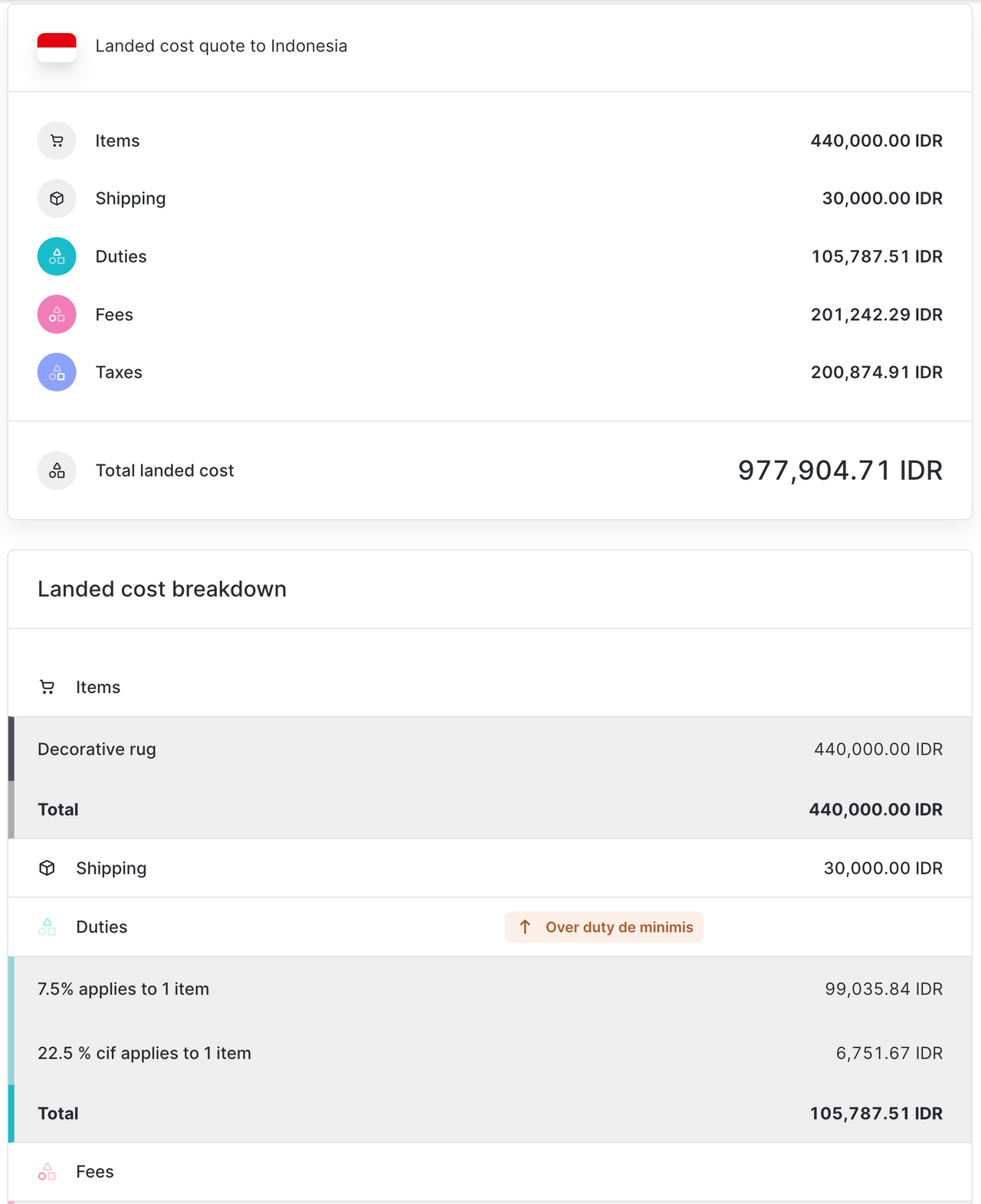

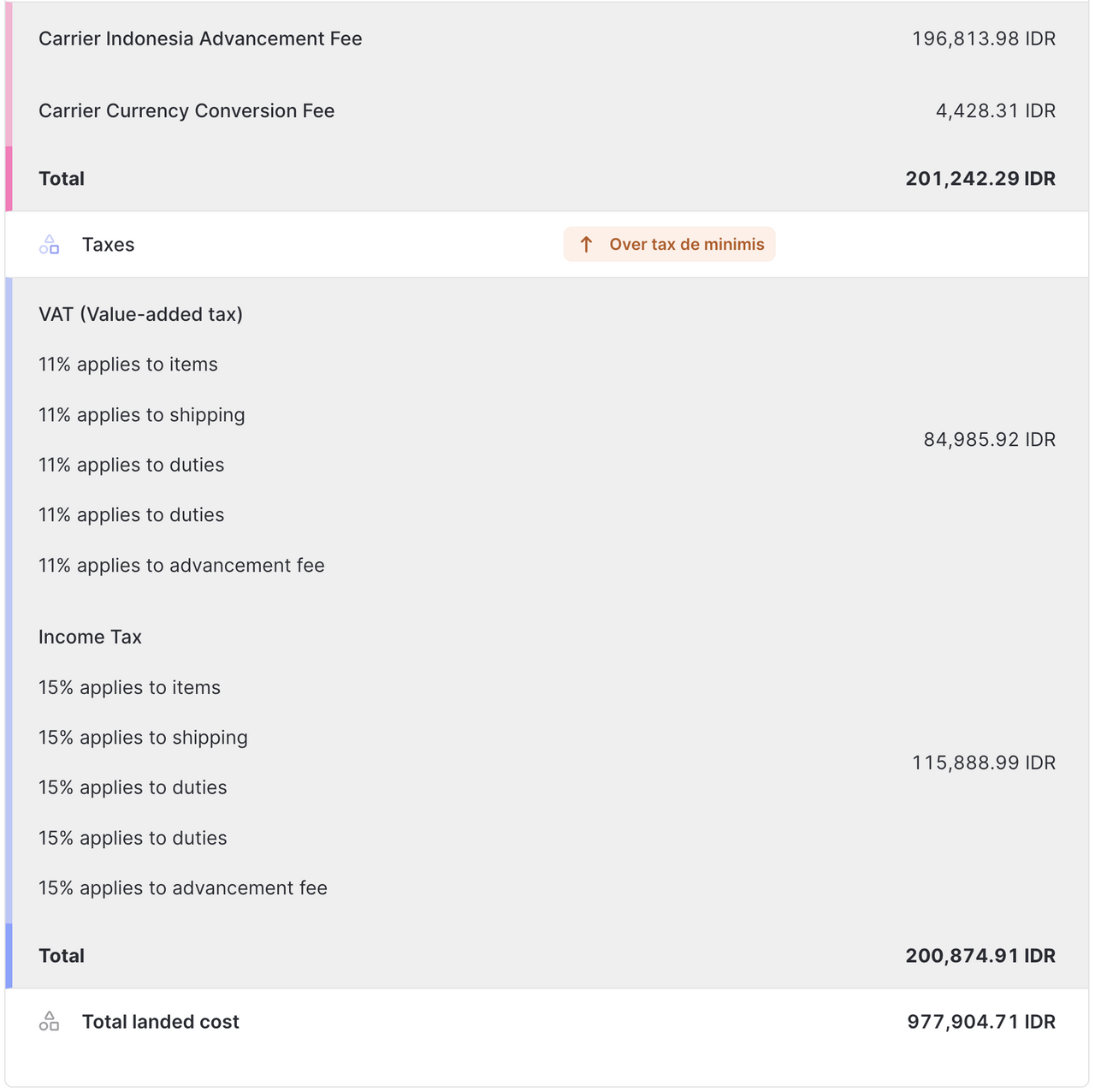

Below are sample landed cost breakdowns for Indonesia calculated using Zonos Quoter. Since there is no tax de minimis, tax will always apply:

Landed cost for a shipment to Indonesia below the duty de minimis value:

Landed cost for a shipment to Indonesia above the duty and tax de minimis value:

Trade agreements

Indonesia has at least 15 trade agreements that offer a zero or highly discounted duty rate for goods manufactured in participating countries.

Indonesia is a member of the World Trade Organization

As a member of the World Trade Organization (WTO), Indonesia must abide by the most-favored-nation (MFN) clause, which requires a country to provide any concessions, privileges, or immunities granted to one nation in a trade agreement to all other WTO member countries. For example, if one country reduces duties by 10% for a particular WTO country, the MFN clause states that all WTO members will receive the same 10% reduction.

Customs resources

Indonesia’s Customs authority

Customs refunds in Indonesia

Customs refunds in Indonesia (Scroll to page 63)

Note: Talk to your carrier about customs refunds.

Shipping and compliance

Top courier services:

- DHL Express

- FedEx

- UPS

- USPS

- JNE

- J&T Express

Depending on the courier, additional shipping fees may include:

- Tracking

- Insurance

- Fuel surcharge

- Remote delivery charge

- Signature fee

- Overweight or oversized fee

- Special handling fee

- Dangerous goods fee

- etc.

Documentation and paperwork

Always needed

-

Pro-forma invoice

-

Packing list

-

Proof of transaction

- All non-document shipments require proof of transaction such as a purchase order, sales contract, or payment transfer.

-

Recipient’s local tax ID number or another national identification number

- If this is not available, the consumer’s phone number is required

- With the tax ID provided, income tax is applied at 7.5%. Without this, income tax is applied at 15%.

Sometimes needed

-

Import licenses based on the product’s Harmonized System (HS) code

-

For example: Tricycles, scooters, pedal cars, similar wheeled toys, and dolls' carriages require the following:

- Survey report (applicable for producer/importer) from Indonesia’s Ministry of Trade

- Indonesian National Standard (SNI) certificate from Indonesia’s Ministry of Trade

-

-

Supporting documents when customs flags an import as suspicious

- Proof of purchase (POP)

- Website link (the website where the item was bought)

- Personal use form (mandatory for medicine and supplements)

-

Certificate of origin

- Necessary for shipments of drugs/medicine and certain products of animal origin

-

Health certificate from the Food and Drug Agency

- Necessary for nutritional supplements, vitamins, and medicines

-

Doctor prescription

- Necessary for prescription medication

Prohibited, restricted, and controlled imports into Indonesia

Government agencies regulate imports.

Restricted items are different from prohibited items. Prohibited items are not allowed to be imported into a country at all. Restricted items are not allowed to be imported into a country unless the importer has approval or a special license. Controlled goods have military or national security significance.

Prohibited items:

- Alcoholic beverages

- Animal products

- Animal skins

- Any materials printed or otherwise that are anti-Muslim in nature or that promote communism

- Books and printed materials that can disturb public order

- Checks in all forms

- Coffee and coffee samples

- Communications equipment

- Compact discs

- Computer software

- Cotton seeds

- Dangerous goods as defined by the International Air Transport Association

- Drugs (prescription and non-prescription)

- Explosive materials

- Firearms and ammunition

- Certain knives

- Fireworks of all types

- Foodstuffs

- Grain samples

- Knives (other than cutlery)

- Medical or dental supplies and equipment

- Precious metals

- Mineral products

- Narcotics

- Machine and electronic parts

- Personal effects

- Personal imports of cell phones, laptops, and tablet computers

- Plants and plant products

- Precious stones

- Products displaying Chinese characters

- Radar equipment

- Radio equipment

- Seeds

- Ship spares

- Video cassettes and tapes

- Telecommunications equipment

- Textile articles

Restricted items:

- Tobacco/tobacco leaves/cigarettes

- Certain telecommunication devices and equipment

- Photocopy machines and parts thereof

- Flora and fauna as defined by the Department of Agriculture, Directorate General of Fisheries

- Materials that are proven harmful to the health and welfare of humans or the environment

- Ozone-depleting substances and devices that contain them

- Pesticides

- Psychotropic substances

- Recorded media that has not been approved for import by the Board of Film Censorship and the Attorney General

- Wastes as defined under Government Law Rep. of Indonesia #12 /1995, Ecological law 23/199

Legal regulations for businesses

Limited quantity

There are certain goods on which Indonesian Customs imposes a quantity-per-shipment limit. Here are a few examples:

-

Laptops - Two pieces per shipment

-

Clothing - Five pieces per shipment

-

Footwear - Two pairs per shipment

-

Toys - Three pieces per shipment

-

Traditional medicine, supplements, and vitamins - Five small bottles, strips, sachets, or tubes per shipment

- For small bottles, the content must be limited to 60 capsules or 500mg per shipment.

-

Cosmetics - 20 pieces per shipment

Recipient import license

Certain products entering Indonesia require an import license. The recipient in Indonesia must apply for an import license in order to import the following items:

- Electronics

- Textiles

- Footwear

- Medical devices and equipment

- Toys

- Sporting goods

- Baby products

- Food products

- Pharmaceuticals

- Household health supplies

- Cosmetics

Frequently asked questions

Is Indonesia’s income tax different from import tax and duty?

In Indonesia, a 10% income tax applies to taxable imported goods in addition to the value-added tax and import duty.

Does Indonesia’s tax registration requirement for foreign sellers apply to both physical and digital goods?

No, Indonesia’s non-resident tax registration requirement only applies to digital or electronic goods and services.

Indonesia country guide

Learn about cross-border ecommerce, shipping, and importing.

If you are looking to grow your ecommerce business into Indonesia , you’ve come to the right place. Keep reading to learn everything you need to know about selling goods into Indonesia.

, you’ve come to the right place. Keep reading to learn everything you need to know about selling goods into Indonesia.